By Charles Eisenstein In George Orwell’s 1984, there is a moment when the Party announces an…

The Case Against GDP, Made By Its Own Creator

The year is 1937 and National Bureau of Economic Research economist, Simon Kuznets, has just presented his report to the U.S. Congress, “National Income, 1929–35.” The report contains his formulation for Gross Domestic Product (GDP), the idea of a single measure to capture all economic production from individuals, companies and government within the US. The calculation method described in the report is viewed as a giant leap forward especially in the context of The Great Depression — a time where the nation was at the mercy of economic forces that it understood poorly.

The invention of GDP was seen as yet another triumph by man over the chaos and complexity of the natural world. Its invention came within the same generation as two other equations now listed among the 17 Equations That Changed The Course Of History — Einstein’s equation describing relativity as well as the most important equation in quantum mechanics, Schrödinger’s equation.

There was great optimism that the lessons and methods of physics and mathematics could be directly and easily applied to the social sciences. The result was a stunningly simple and elegant equation that many thought was all one needs to describe economic life: Y=C+I+G+(X-M). The equation still taught to undergrad economics students today.

Acceptance and efficacy

Seven short years after its introduction, GDP was made the global standard at the Bretton Woods Conference in New Hampshire.

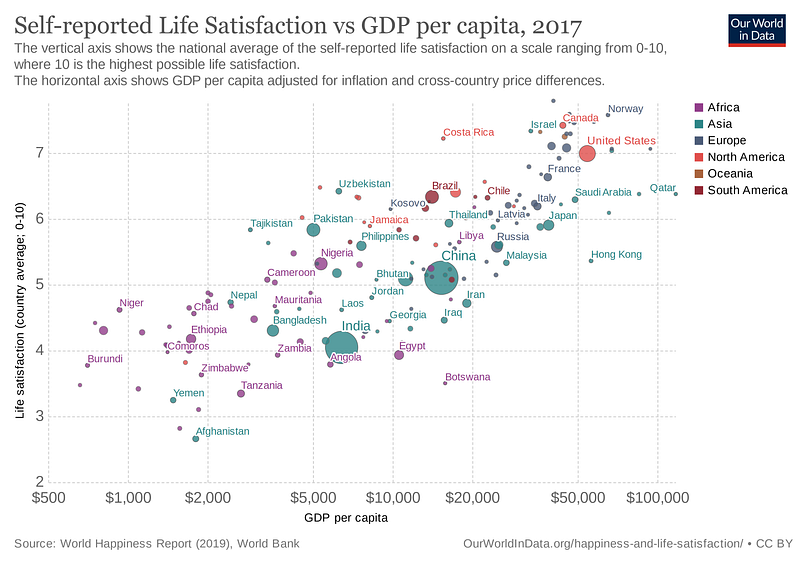

Given the state of economic knowledge at the time and the resources he had to work with, we can rightfully conclude that Kuznets’ GDP formulation was indeed a step in the right direction. When put to the test GDP does a decent job at predicting things we care about such as happiness or life expectancy — certainly better than the other tools Kuznets would’ve had access to in 1937. Looking at the graph below we can easily eyeball a strong correlation between self reported life satisfaction and per capita GDP by nation at a point in time.

But when you zoom in the evidence gets murky. For instance, it has been shown that US income per capita during the period 1974–2004 almost doubled yet the average level of happiness showed no appreciable upward trend. This puzzling finding is called the Easterlin Paradox and has been confirmed in similar studies in Europe.

One explanation which seeks to reconcile the Easterlin Paradox with data from the graph above states that the positive relationship between happiness and GDP per capita vanishes beyond a certain level of GDP per capita. Recent studies suggest countries with GDP per capita over $20,000 see a much less obvious link between GDP and happiness. To the extent that this theory is true it’s easy to understand how GDP was so quickly accepted in the hand-to-mouth first half of the 20th century. It’s also easy to understand how that now many nations are past the $20,000 per capita GDP level that there’s such a groundswell of support to think beyond GDP.

Where it went wrong

The problem wasn’t the introduction of an imperfect indicator (that is quite understandable) but rather the full throated support and unquestioned acceptance it received. Perhaps if world economic leaders would have heeded Kuznets’ own warning about the measure he created we could have prevented what Joseph Stiglitz has referred to as the “fetishization of GDP.” Even before Kuznets’ testimony before the US Congress he was quoted as saying “The welfare of a nation can scarcely be inferred from a measurement of national income.” Some 30 years later Kuznets said “Distinctions must be kept in mind between quantity and quality of growth, between its costs and return, and between the short and the long term. Goals for more growth should specify more growth of what and for what.”

His sounding of the alarm fell on deaf ears, for it was around the same time that President Kennedy’s advisor, Arthur Okun coined “Okuns Law” which further enshrined the “Gospel According To GDP.” By the late 70’s GDP was being calculated for over 100 countries. Each successive “law” built on top of GDP communicated a false scientific confidence which shut down the appetite for an inquiry into the efficacy of GDP as “the one and only” national economic account.

Had the economists of the era had more of a reverence for the scientific method rather than an unrepentant envy of physicists and mathematicians they could have incrementally built upon the pros of GDP while minimizing its cons. They could’ve realized that the positive relationship between per capita GDP and happiness breaks above a certain level and can even become negative. Economists could’ve factored in relatively easy to measure things such as crime statistics, income distribution and air quality to paint a fuller picture of national quality of life. This would have required us to make our elegant equation messy or maybe even make multiple equations…Oh, the horror!

A measure entrenched

The problem is not that we measure GDP, it’s that it has become the de facto stand in for national well being and fails to consider other relevant factors. GDP has been positioned as a “1 of 1” when it’s really “1 of many” factors that matter.

When China began calculating a new “green GDP” measure, which accounted for negative impacts of economic growth on the environment, they found that it would have lowered their 2004 GDP by 3 percentage points — from 10% to 7%.

What would the equivalent adjustment look like for the US?

A better question would be what would the equivalent adjustment look like for China today? We don’t know because the “green GDP” project was dropped by the Chinese government after pressure from regional and local proponents of economic growth. This blind adherence is what Joseph Stiglitz means when he refers to the “fetishization of GDP” and its exactly what Simon Kuznets was hoping to avoid when he introduced GDP as a national accounting method.

The point

It’s understandable that an imperfect measure was introduced and became widespread. What’s not acceptable is that this remains the case. Now that we fully understand the limitations of GDP we must not continue to hold it as the primary indicator of economic progress. If economists are to emulate and envy physicists we ought to strive to be more empirical and account for all factors. Practicing full cost accounting is inconvenient but it is what is required. Measures such as Genuine Progress Indicator and Gross National Happiness aren’t perfect — they only approximate the full cost accounting that we seek, but like GDP in 1937 they are a giant leap over the status quo.